Construction loans are also called draw mortgages. Construction draws is the process of your lender providing financing to you, which you will then use to pay contractors and for supplies. Your lender may provide the funds to your lawyer, who in turn will disburse the funds to your contractor. Other lenders might only deal directly with the contractor. Regardless of who gets the money from the bank, they usually require a construction plan or a budget for the project. It is important to have a clear budget to increase the chances of getting the loan. You may talk to the contractor directly or use different calculators to estimate the amount of resources a project requires. For example, if you are building a staircase, you can use a stair calculator to estimate how much material you will need for that project.

Draws are paid out in stages of the home construction process. This means that the contractor does not receive the entire loan amount upfront to build your home. Instead, the contractor will only receive money proportionate to the completion of the house. This ensures that the construction loan funds are used towards constructing the home.

Most lenders will allow you to borrow up to 75% of the construction cost. This means that you will need to pay for 25% of construction costs out of your pocket.

If you are not using a general contractor or a home builder, a self-build construction loan provides financing if you are building your home yourself. However you will need to have the necessary experience to do so.

Depending on the type of home you want to develop, there will be a big difference in construction costs. Builders offer two types of home construction plans; stock and custom-built homes. Stock homes are pre-designed to build efficiently. However, you have less control over the design.

A custom home can be completely designed to meet the owner’s wants. However, they are a lot more expensive. Stock homes range towards the bottom of the cost per square foot to build. Whereas custom homes can exceed $700 per square foot in construction costs for most cities. The final price of a custom home will depend on many factors, and one of the most important ones is the size of the property. The larger the size, the more materials are needed for the project. For example, a larger house may require you to calculate the amount of concrete needed for the foundation, which may increase largely with the size of the house.

| City | Cost per Square Foot | Average Home Size | Total Building Costs |

|---|---|---|---|

| Toronto | $115 – $900 | 2,380 | $273,700 – $2,142,000 |

| Montreal | $105 – $800 | 710 | $74,550 – $568,000 |

| Vancouver | $145 – $1090 | 1,900 | $275,500 – $2,071,000 |

| Edmonton | $130 – $860 | 1,950 | $253,500 – $1,677,000 |

If you are building a stock home in the Greater Toronto Area housing market, you can expect the cost per square foot to range between $115 – $215. If the home you are building is 2,380 square feet, you can expect to pay $392,700 in construction costs (assuming $165 per square foot).

Additionally, you will need to purchase land in Ontario. As shown in our how much does it cost to build a house article, the average cost per acre in Ontario is $11,446. You could also use a different mortgage to buy land.

This results in $404,146 which should be multiplied by a 20% safety buffer. The final cost is $484,975. Assuming you finance with a 75% loan-to-value, you will need a down payment of $121,244.

A construction draw schedule outlines when construction draws are paid. A draw schedule is negotiated before construction begins by the contractor. While the bank might already have a standardized draw schedule, your contractor or the bank’s appraiser may propose alternate payment schedules. This can be due to differing construction timelines or costs. Construction draw schedules can be based on milestones, such as when the foundation or roof is complete, or a general percentage of the total home finished.

Interest only starts incurring once each construction draw is disbursed. As a borrower, you may want to receive draws as late as possible to reduce interest costs during construction. On the other hand, the contractor would want to receive their pay as early as possible. If your contractor or lender proposes an alternative payment schedule, you should review it to ensure that it allows your contractor to be paid on time, but is also reasonable.

| Draw Number | Milestone | Draw % of Total |

|---|---|---|

| First Draw (If Land Not Owned) | Purchasing Vacant Land | 65%-75% of land cost |

| First Draw (If Land Already Owned) | Excavation and Foundation | 15% |

| Second Draw | Roof Finished | 40% |

| Third Draw | Plumbing, Wiring, and Drywall | 65% |

| Fourth Draw | Interior Finished | 85% |

| Fifth Draw | Construction Complete | 100% |

| Work Completed | % of Total |

|---|---|

| Excavation | 2% |

| Foundation | 6% |

| Framing | 15% |

| Roofing | 2.5% |

| Windows | 3% |

| HVAC | 4% |

| Drywall | 5% |

| Painting | 6% |

| Total | 100% |

Most lenders, such as banks, usually only allow four draws. Other lenders can be more flexible and allow a greater number of draws. Your lender will send an appraiser to check on the progress of the home before a draw is paid. An inspection fee can be charged each time, depending on your lender.

You still have to make monthly payments on your construction loan, even if construction is ongoing and your home is not occupied. Some lenders, such as Meridian Credit Union, only require monthly interest-only payments during construction. You will be required to make principal and interest payments once construction is complete.

Some construction lenders may even allow you to use future construction draws to pay for interest on the loan.

Similar to a down payment made for a conventional mortgage, construction loans may require you to put money up front to pay for construction expenses. However, unlike conventional mortgages, the collateral for a construction home is an unfinished home. As it has a lower value than a finished home, construction loans are riskier for lenders. To see whether you can afford the construction loan, and eventually afford a mortgage, your lender will look at your income, debt levels, and credit score. Eligibility requirements for construction loans are stricter than regular mortgages.

If you do not already own land to build on, your first construction draw would usually be used to purchase the land. This first draw can be paid in advance before construction starts, and can be from 65% to 75% of the cost of the land. Not all lenders pay the first draw in advance. You might be expected to cover the vacant land purchase cost with your own money.

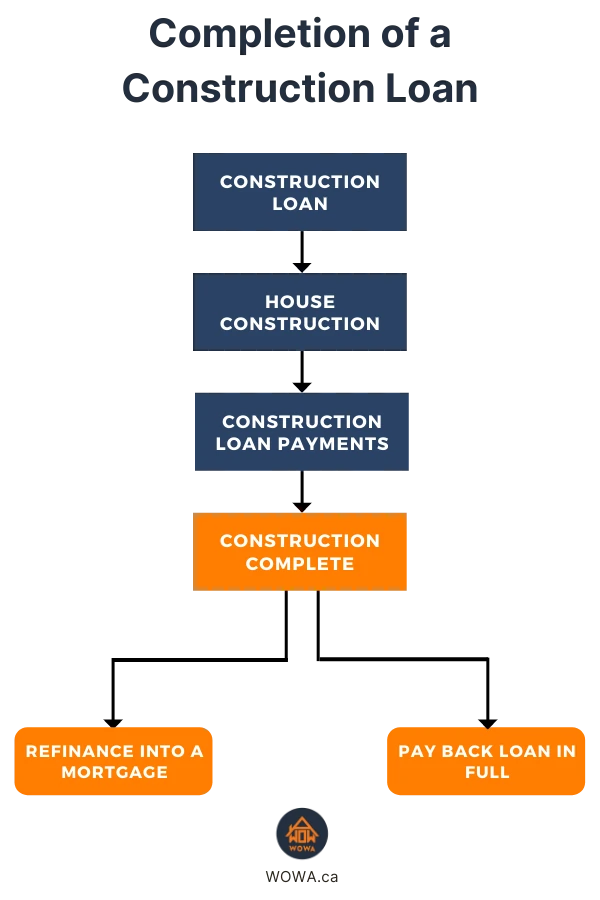

Once construction of the home is completed, the construction loan would either need to be refinanced into a conventional mortgage or paid off in full.

Contractors do not receive the total amount of any construction draw. A construction holdback, required by a province’s Builders’ Lien Act, withholds 10% from payments that you make to your general contractor. Once construction is complete, the remaining 10% will be paid to the contractor after a minimum holding period of 45 days. British Columbia’s Builders Lien Act and Alberta’s Builders’ Lien Act have such requirements. The naming of such laws and regulations differ by province, such as Ontario’s Construction Lien Act.

Your contractor has 45 days to file any lien claims against your property after construction is finished. You can be asked to sign a Certificate of Substantial Completion, often done once 97% of the home is complete. You do not have to sign this certificate if you are not satisfied with the contractor’s work.

You can borrow more on your mortgage for home improvements with an improvement mortgage. Some lenders offer home improvement mortgages, which give you an additional amount on top of the home’s purchasing price in order to pay for minor improvements.

For example, Meridian’s Purchase Plus Improvement Mortgage allows you to borrow up to 20% of the home’s purchase price, up to a maximum of $40,000. You will then use this mortgage to purchase the home. You will only receive the additional improvement funds once you have completed the improvements, as they are not paid upfront.

Since home improvements can increase the property value, the mortgage down payment required for the mortgage will also increase. The down payment will be calculated on the new value of the property, or the purchasing price of the property plus the improvement costs, whichever is lower.

If you are constructing multi-unit rental housing, you may qualify for funding by the Canada Mortgage and Housing Corporation. You can receive up to 100% of construction costs or 85% of the property’s lending value, whichever is less, with a minimum of $1,000,000.

CMHC rental construction financing provides CMHC mortgage loan insurance for free. No CMHC premiums are required. CMHC financing is on a 10-year term with a fixed interest rate, for up to a 50-year amortization period. Only interest payments are required during construction.

The CMHC will charge you an application fee. The application fee is $200 per residential unit, or 0.3% of the loan amount over $100,000 if it is non-residential. The program is fully explained on CMHC’s webpage for the Rental Construction Financing Initiative.

The fund is designed to finance the development of energy-efficient, accessible and socially inclusive housing throughout Canada. The housing can be for mixed-income, mixed-tenure and mixed-use affordable housing purposes. Builders can receive up to a 95% loan-to-cost through low-interest and forgivable loans.

The low-interest loans offer a 10-year fixed interest rate. You can also receive up to a 50-year amortization period. Projects with low cash flow are eligible to receive forgivable loans. However, they will not be prioritized for funding. You can learn more and apply to the program through CMHC’s National Housing Co-Investment Fund webpage.